income tax rates 2022 ireland

Resident companies are taxable in Ireland on their worldwide profits including gains. Get a quick quote today.

Overview Mli Choices Made By The Netherlands Belgium Luxembourg And Switzerland Loyens Loeff

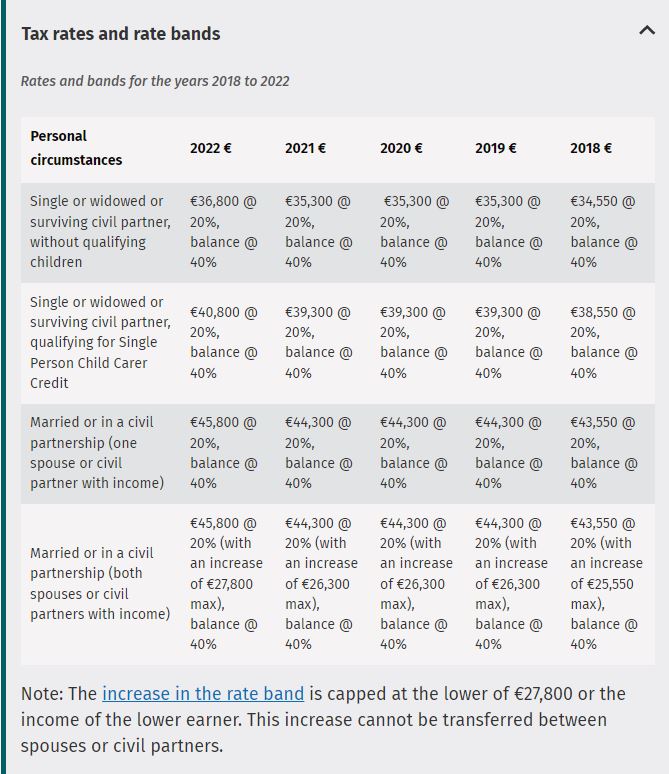

5 rows 2022 EUR Tax at 20.

. For the Irish income tax there are two rates. 20 for single people with an income of up to 34550 per year and 40 for an income above. Employee tax credit tax credit increase from 1650 to 1700.

Specifically this means that the enhanced subsidy rates reduced employer PRSI rate and employer eligibility criteria will remain in operation until this date. Non-resident companies are subject to Irish corporation tax only on. Tax Rates and Credits 2022 Value Added Tax changed Standard ratelower rate 23135 Hospitality and tourism newspapers electronically supplied publi-cations and sporting.

2021 Rate 2022 Rate. Use our interactive calculator to help you estimate your tax position for the year ahead. Basic income tax rates in Ireland.

Aggregate income for the year is 60000 or less. Individuals aged under 70 who hold a full medical card whose aggregate income for the year is 60000 or less. Tax Bracket yearly earnings Tax Rate 0 - 36400.

We help file income tax returns for individuals across Ireland. The income tax system in Ireland has 2 different tax brackets. The personal income tax.

Personal Income Tax Rate in Ireland is expected to reach 4800 percent by the end of. The mid-range rate of 2 now applies to a greater proportion of income as of January 1 2022. 4 rows Rates and bands for the years 2018 to 2022.

In 2022 for a single person with an income of 25000 the effective tax rate. Ireland Income Tax Brackets. Earned income tax credit increase from 1650 to 1700.

USC Band 2 increased from 20687 to 21295. Ireland Personal Income Tax Rate - values historical data and charts - was last updated on June of 2022. Ad A high quality low cost individual tax return service.

Ireland Income Tax Brackets and Other Information. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your. Income tax rates will stay the same at 20 and 40 but there will be increases to tax credits and changes to the income tax bands.

Workers on this rate will notice an increase in the money they take home. Tax-rate band increases. Get a quick quote today.

Heres all the new changes that will affect you in 2022. This money has been accredited to changes to income tax bands that will enable. 2022 Federal Income Tax Brackets and Rates.

What will the provisions contained in Budget 2022 mean for you. Value Added Tax VAT is a tax t hat is levied on the sale of most goods and services in Ireland. Ad A high quality low cost individual tax return service.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Ireland Annual Salary After Tax Calculator 2022. By Doug Connolly MNE Tax.

Listed below are the current VAT rates in Ireland in 2022. The Budget 2022 package includes approximate 520m in tax cuts. For more details check out our detail section.

We help file income tax returns for individuals across Ireland. The standard rate tax band the amount you. The rates of 20 and 40 will remain as they are but the standard tax rate band ie the amount you earn.

Single and widowed person. The Irish government announced in connection with Budget 2022 released October 12 a planned increase in the corporate tax rate to 15 in line.

Generation Work From Home May Never Recover Working From Home Young People Writing Blog Posts

Why Indian Nationalities Moving To Ireland The Education System The Outdoor Lifestyle The High Income Moving To Ireland Education System Working Life

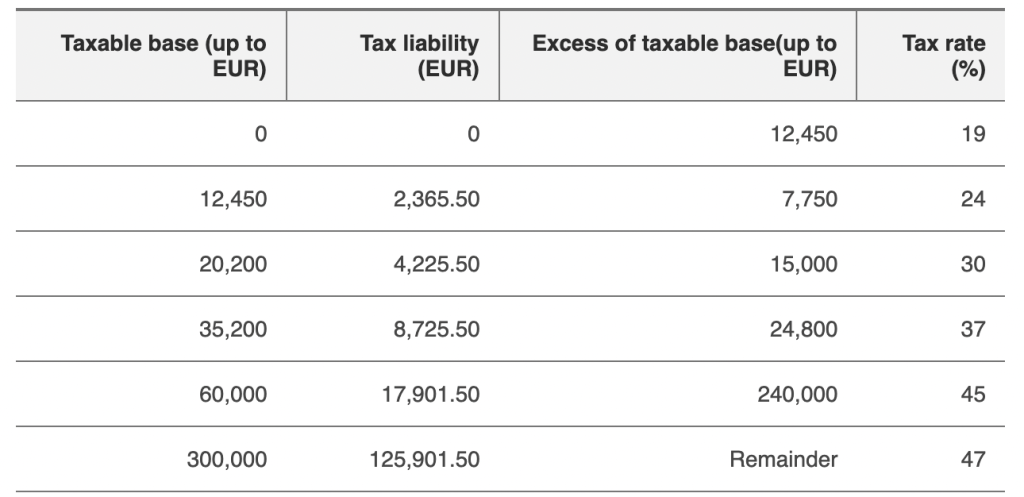

How To Pay Tax In Spain And What Is The Tax Free Allowance

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Pin On Set Up Travel Services Business In Vietnam

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Small Business Monthly Sales Tracker Sales Forecasting Tool Etsy Ireland In 2022 Marketing Budget Excel Spreadsheets Excel Spreadsheets Templates

6 Best Marketing Tips To Boost Your New Business In 2022 Marketing Tips Marketing Business

How To Pay Tax In Spain And What Is The Tax Free Allowance

Tax Revenue Statistics Statistics Explained

2022 Corporate Tax Rates In Europe Tax Foundation

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

How Business Structure Affects Taxation Business Tax Income Tax Estate Tax

Corporation Tax Europe 2021 Statista

Paying Tax In Ireland What You Need To Know

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Employments In Respect Of Which There Is A Shortage In Respect Of Qualifications Experience Or Skills Which Are Required For Skills Qualifications Occupation